Well as this week’s flown by it has been yet another one where the overall market is down in the red. As I said in the last post where I made My First Ever Green Trade, it does not matter which direction the market is heading as there’s money that can be made every single trading day. I’ve made no trades this week as I’ve been busy sorting out the big house move which is finally happening at the end of this month! Hoorah! Very exciting with lots still to do!

Well as this week’s flown by it has been yet another one where the overall market is down in the red. As I said in the last post where I made My First Ever Green Trade, it does not matter which direction the market is heading as there’s money that can be made every single trading day. I’ve made no trades this week as I’ve been busy sorting out the big house move which is finally happening at the end of this month! Hoorah! Very exciting with lots still to do!

Although I have been juggling life and sorting various things out away from trading, I still keep a watchful eye on the stock market and study where I can, as well as constantly learn more from Tim Sykes every day. I will soon do a review on Tim and Profitly to prove that the value he gives is ridiculously priced and should be ten times what he charges, but I’m not complaining!

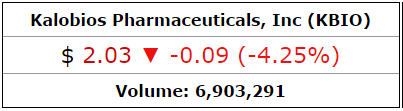

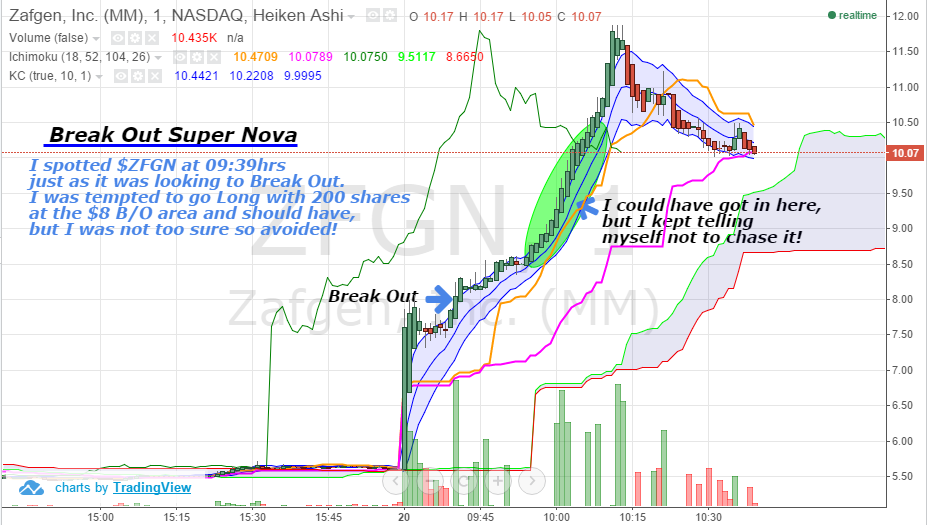

So anyway, there have been a few good plays that were possible this week and the best one was that of $ZFGN which I was right on top of before it spiked and ready to trade, but as it was in the $8 mark I told myself that it was too high priced to trade with my small account. I could have made $300 to $600 potentially if I’d have entered my trade, but that’s hindsight for you!

Any hows I wanted to do a quick simple post on learning to trade good set ups, hence the title name for this post! So lets get on with the shoooooow 🙂

How To Take Consistent Good Trades

Like all traders everyone has their own personal set up with what works best for them and it differs from trader to trader…… well unless your a sheep trader!!

As I continually refine my trading set up which will always be the case as you never stop improving, I have discovered a consistent set up that works for me.

Yes I still only have one winning trade out of four trades so far, but I know that I am on the right track and onto a consistent winning strategy!

As mentioned in a previous post, I noted that I was personally finding the level 2 tool more of a hindrance than a helpful one. It is by trial and error that you discover what works best so long as you adjust things so that you’re not just banging your head against wall street while hoping for a different result!

So while discovering what works best for me I have found that I get the same results every time when these key factors appear and my trading signals are in place! I will go into much more detail once I have some more proof with successful trades to share. Sorry to be this secretive, but I still need more successful trades to prove it first.

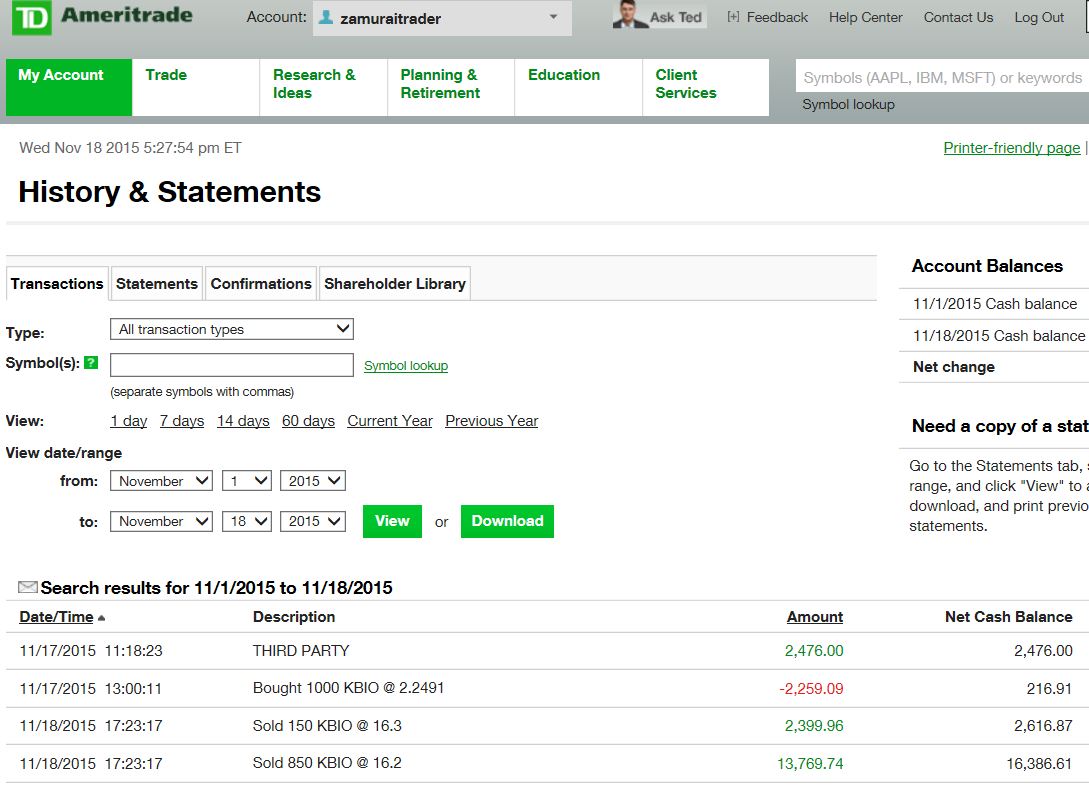

What I will say is that “Break Outs” are appearing to be the most lucrative form of play and implimented strategy for me!

Now having a good trade set up and strategy that works is essential, but of course the big key to pulling off good trades no matter what your strategy is, is getting to the stock before it spikes.

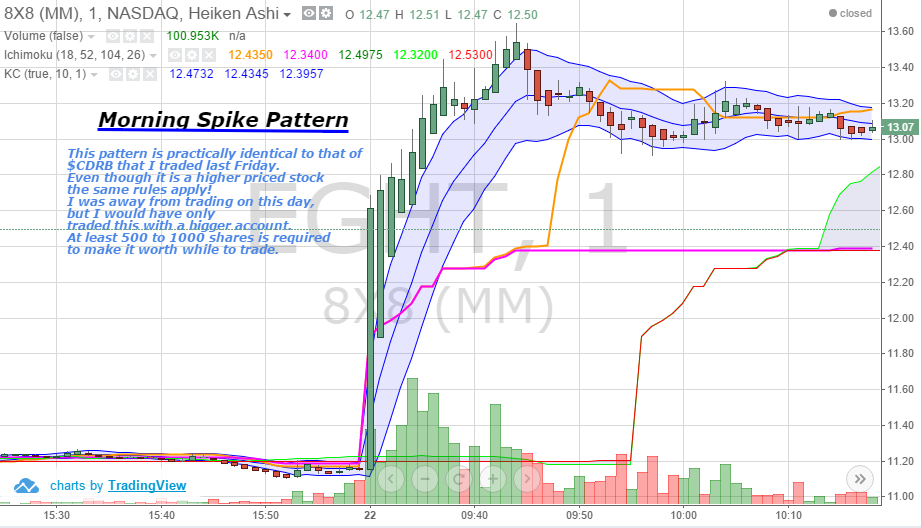

The strategy that I’m fine tuning I have learnt and continue to learn from Timothy Sykes so it is not my very own or anything new. What I have done though is tested out how to trade morning spikes with different tools to know when to enter these types of stocks that spike before it is too late and also when to exit.

It is only through trial and error that you really find out what works best, much the same as when you buy a new iphone, television or any other gadget for that matter you have to take some time out to figure out what all the buttons do, so you then know how to use it properly! Simples right?!

So while I’ve been adjusting certain settings to the two tools I use (Ichimoku and Keltner) I’ve also discovered that it works with currency pairs.

I still intend to stick to trading penny stocks over all, but I am also learning about other financial instruments which are very active that does spark my interest to master trading them, but lets master one step at a time first!

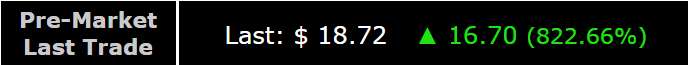

Oh Yeah, I Also Turned $2000 into $4000 This Week!!

Now before we all go crazy on this heading, these figures are only in virtual money! Shucks I know, but there is great progress and excitement as to how I did it!

It is not the sum of money that I created in such a short time that excites me, but more over how I did it as I can do the exact same thing with real money! I stuck to the same strategy through out and I did NOT increase my risk with how much money I put on the line to lose.

I was close to being right 75% and actually better as I was mostly testing out and fine tuning with what works and what doesn’t work. Funnily enough it is Timothy Sykes’ methods that I have applied to trading this!

So believe it or not it is actually through trading binary options that I have been fine tuning my technique with virtual money. By doing this I can get better at entering and exiting trades while using the ichimoku and keltner channel and testing out what works best. It doesn’t really matter whether you’re using these two tools to trade stocks, currencies or even commodities as the principles remain the same with a few little tweaks here and there of course.

I highly recommend NOT I repeat NOT to trade binary options as you will get burned if you are totally new to it or don’t know what you are doing! I dabbled with a couple hundred bucks and attempted binary options a good six years ago or so with no knowledge, plan or even strategy other than go with the trend!! I was an uneducated sheep back then and now I am the sniper that only takes shots when the right set up and signals are in place to trade it!

I will share my technique and strategy once I have some solid successful trades with real money to prove it. So yeah this is a bit of a wishy washy post overall, but I just wanted to share with you that I’m continually improving my winning trading strategy and I will keep doing this so that I can show you what works and what doesn’t work and hopefully inspire you along the way! 😉

Another Key Ingredient To Successful Trading

I named this post as “The Good, The Bad and The Pretty” as I wanted to get the point across of what it takes to become a good trader, but also what a good trade set up looks like with the strategy I am mastering.

To become an excelled trader takes many many many hours of studying and learning what works in the stock market, but this can also be speeded up by learning from ONLY the best that can prove it like that of Timothy Sykes which is what I’m doing.

Besides learning from the very best like Tim, I am honing in on my own style and unique formula that works best for me, so that I am fully self sufficient.

~Give a man a fish and you feed him for a day. Teach a man to fish and you feed him for a lifetime~

In order for me to be successful at trading I am thinking for myself as opposed to just wanting hot stock picks to make money with! I listen to Tim and study his techniques every single day, but once the market opens I trade with my own entry and exit plans.

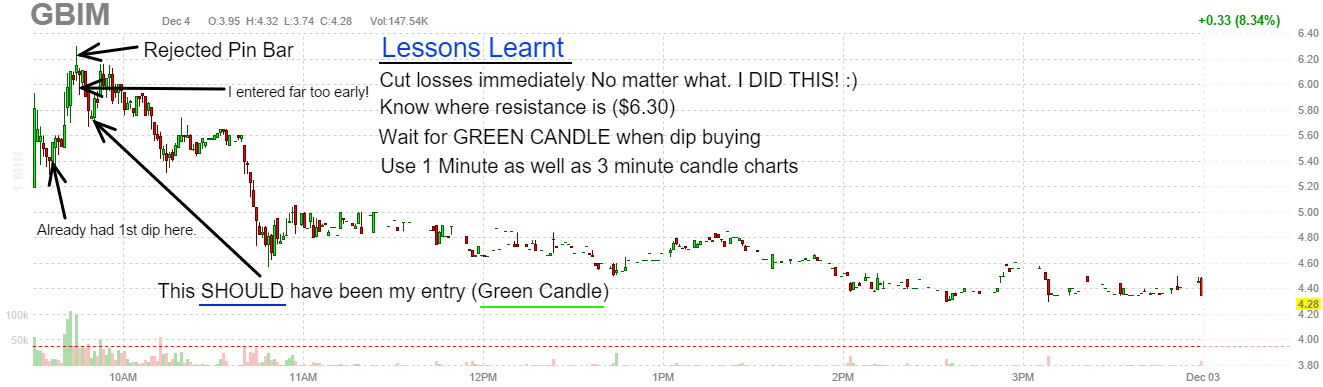

So you see there are many bad traders out there, and statistics say that about 90% of traders lose their money consistently well! There are many reasons why this is the case, but the main reason for this is because they have not got a winning strategy, have learnt the wrong methods and lack discipline of the number 1 rule which is to cut losses quickly!

Rounding this post Up

As I gear up to move into my new home this coming week and I set sail, ship and anchor, I will still be looking to trade at the market open, but only if the right set up presents itself.

To finish off and keep things interesting, here’s a couple of very pretty charts that are the ones I look to trade before they spike like this!

I will share what good ones and bad ones look like all in good time and explain how it all works.

Until next time, enjoy the final week of January 2016 and stay tuned for…… 🙂

Today is the 18th January 2016 and it is Martin Luther King Jr’s birthday.

Today is the 18th January 2016 and it is Martin Luther King Jr’s birthday.

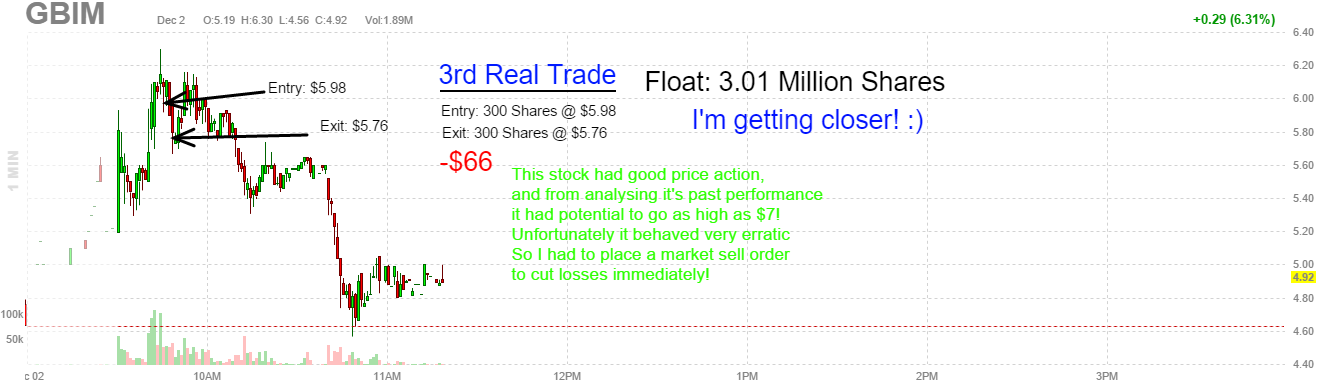

So I’ve finally experienced what it’s like to trade penny stocks with real money this week just gone, and although it has been a losing one financially, it has been a very educational one with loads of valuable points and lessons gained.

So I’ve finally experienced what it’s like to trade penny stocks with real money this week just gone, and although it has been a losing one financially, it has been a very educational one with loads of valuable points and lessons gained.

With having the first three days of freedom fly by so fast already, I’ve finally gotten the chance to focus on the stock market and be more prepared to trade with precision.

With having the first three days of freedom fly by so fast already, I’ve finally gotten the chance to focus on the stock market and be more prepared to trade with precision.